After continuously weakening from 10-year highs due to positive supply information in the world’s top corn producing countries such as Brazil, Ukraine and the US, corn prices are showing signs of recovery.

At the end of the trading session on June 7, the price of July corn futures contract, which was traded internationally at the Commodity Exchange of Vietnam (MXV), jumped 1% to 765 cents/ bushel (300) USD/ton). This was the third strong gain in a row, after corn prices cooled down and weakened about 10%, from the peak set at the end of April.

The longer the green color lasts, the more fear of another price rally increases. Because the supply of feed ingredients depends on imports, fluctuations or trends in the world agricultural market will directly affect the production cost structure of the livestock industry in Vietnam.

According to the latest data from the General Department of Vietnam Customs, the volume of corn imported in May of Vietnam reached 1.03 million tons, more than double that of April. Many livestock enterprises have taken advantage of the period. cooler than the past to promote purchases. For long-term trading, demand is still strong but mills are still expecting a further drop in prices. So what are the factors currently affecting the world corn supply?

Brazil’s corn production is no longer a concern of the market.

Much of the second corn crop, which accounts for about 75% of Brazil’s corn production, will be exported. Although crop yields have been severely affected by drought during the past 3 months, this is no longer a concern that can push corn prices to continue to increase sharply in the near future. The rise in corn that has lasted since the end of last year is partly a reflection of crop losses in the world’s second-largest corn exporter. This has been reflected in reports and estimated cuts in Brazilian corn production for the 2021/22 crop year by major news agencies and organizations around the world.

However, the situation is getting better for the current harvest period. If a month ago, the Brazilian government’s Crop Supply Agency (CONAB) said that the crop will be damaged, in the report released last night, they raised the production forecast to 115.22 million. ton. Previous concerns about the Brazilian crop will gradually be eased in the coming period as farmers step up harvesting activities.

Will Ukraine’s grain flow be resumed?

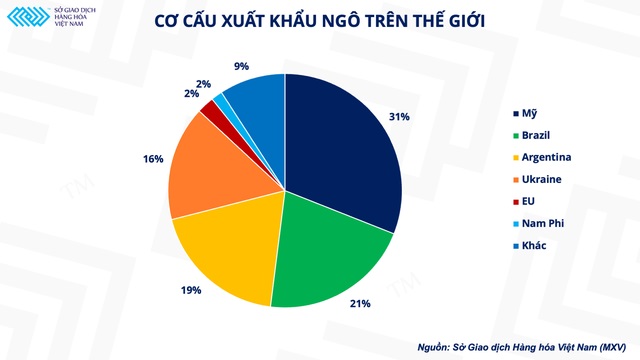

The factor that has caused the dramatic fluctuations in the corn market in the past few months cannot but be mentioned the political tension in the Black Sea. The export ability of Ukraine, which supplies about 16% of the world’s corn, is the information that keeps corn prices anchored at high levels.

Earlier this month, Russian President Putin reaffirmed the opening of a humanitarian corridor for grain ships to resume grain exports in the Black Sea. If Russia follows through on its plan, it may open the door for the opportunity to help Ukraine’s grain supply return to the international market.

In addition, Ukrainian authorities also set a prospect of resumption of grain exports through ports on the Danube. Not only Russia and Ukraine, the global food security issue also pushed neighboring countries such as Poland, Türkiye, and Belarus into action. Recently, Polish Prime Minister Mateusz Morawiecki said the country was ready to develop the infrastructure to transport grain from Ukraine to the Middle East and Africa.

According to the Ministry of Agriculture of Ukraine, the picture of exports in the country has gradually returned to positive when in May, the volume of cereals shipped to the world increased by 80%, reaching 1.74 million tons. Maize is also forecasted to be a major item in export shipments in June.

Positive changes in weather help speed up US corn planting

If the cooling of the political conflict is the salvation of corn exports in Ukraine, favorable weather is a big lever for the prospects of the crop in the US. At the present time, the corn crop in this country has begun to move into the growing stage and the weather is still the top concern that determines the price trend.

In early May, prolonged rainstorms in the Midwest, the main growing area of the United States, caused continuous delays in planting progress. The risk that crops may experience a dry season when they are not fully developed and resilient has raised concerns about reduced crop yields. In addition, the skyrocketing fertilizer price at the beginning of the year is also considered as a barrier to the decision to expand the planting area. Both productivity and acreage are at the moment a signal of possible tighter supply in the US.

However, in the past 2 weeks, dry weather has started to return, helping the crop speed to improve rapidly. In the recent Crop Progress report from the US Department of Agriculture (USDA), corn planting progress in the 2022/23 crop year as of this week has reached 94% of the projected area and is above the 5-year average. Improvements in weather conditions have allayed concerns about a delayed corn crop.

According to the Vietnam Commodity News Center, the fact that all three major agricultural products in the world have positive signals about the supply will likely untangle for importers about input costs in the near future next.